Tutorial Forex part I

What is Forex ?

The Foreign Exchange market, also referred to as the "Forex" or "FX" market, is the largest financial market in the world, with a daily average turnover of well over US$1 trillion -- 30 times larger than the combined volume of all U.S. equity markets. Unlike other financial markets, the forex market has no physical location or central exchange. It is an over-the-counter market where buyers and sellers including banks, corporations, and private investors conduct business. A true 24-hour market, Forex trading begins each day in Sydney, and moves around the globe as the business day begins in each financial center, first to Tokyo, London, and New York.the unmatched liquidity and around-the-clock global activity make forex the ideal market for active traders.

Pair

Currencies are quoted in pairs, such as EUR/USD or USD/JPY. The first listed currency is known as the base currency, while the second currency is called the counter or quote currency. The base currency is the "basis" for the buy or the sell. For example, if you buy EUR/USD you have bought Euros (and simultaneously sold dollars). You would do so in expectation that the Euro will appreciate (go up) relative to the US dollar. FX is traded in lots, which represent 100,000 units of the base currency. If the EUR/USD is quoted at 1.2253, that means that one Euro is currently worth just over $1.22. If the market moves from 1.2253 up to 1.2254 that represents a move of one pip. A pip is the smallest increment a currency pair can move and in the case of the EUR/USD currency pair a pip is worth $10 in a 100K account and is $1 in a mini account.

Leverage

Leverage allows traders to borrow money and use that money to invest in the foreign exchange market. Because of leverage, clients without a huge amount of capital are able to make large investments, whereas in other markets such as the equities market, clients would have to pay 50% of the full amount for each share of stock they were investing in. Most market makers allow positions to be leveraged up to 100:1. This means that if a trader wanted to buy a “lot” worth $100,000, with 100:1 leverage the trader only has to put up $1,000.

Leverage is about risk. Increasing your leverage increases both your opportunity to take bigger profits AND rack up bigger losses.

Margin

Margin is a performance bond, or good faith deposit, to ensure against trading losses.

How are leverage and margin related?

The amount of leverage a market maker gives to a client defines the amount of margin that the client will have to commit in order to take a position in the market. For example, when leverage is 100:5, the “5” in the leverage ratio signifies the amount of capital the customer has invested of his own money, which is also known as the margin.

Bid and Ask

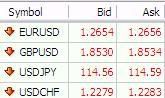

The bid rate is the price at which traders can sell the pair. The ask rate is the price at which traders can buy the pair.

This is the example of bid and ask on major currencies:

The ask rate will always be higher than the bid rate. The difference between the bid rate and the ask rate is the spread.

The Foreign Exchange market, also referred to as the "Forex" or "FX" market, is the largest financial market in the world, with a daily average turnover of well over US$1 trillion -- 30 times larger than the combined volume of all U.S. equity markets. Unlike other financial markets, the forex market has no physical location or central exchange. It is an over-the-counter market where buyers and sellers including banks, corporations, and private investors conduct business. A true 24-hour market, Forex trading begins each day in Sydney, and moves around the globe as the business day begins in each financial center, first to Tokyo, London, and New York.the unmatched liquidity and around-the-clock global activity make forex the ideal market for active traders.

Pair

Currencies are quoted in pairs, such as EUR/USD or USD/JPY. The first listed currency is known as the base currency, while the second currency is called the counter or quote currency. The base currency is the "basis" for the buy or the sell. For example, if you buy EUR/USD you have bought Euros (and simultaneously sold dollars). You would do so in expectation that the Euro will appreciate (go up) relative to the US dollar. FX is traded in lots, which represent 100,000 units of the base currency. If the EUR/USD is quoted at 1.2253, that means that one Euro is currently worth just over $1.22. If the market moves from 1.2253 up to 1.2254 that represents a move of one pip. A pip is the smallest increment a currency pair can move and in the case of the EUR/USD currency pair a pip is worth $10 in a 100K account and is $1 in a mini account.

Leverage

Leverage allows traders to borrow money and use that money to invest in the foreign exchange market. Because of leverage, clients without a huge amount of capital are able to make large investments, whereas in other markets such as the equities market, clients would have to pay 50% of the full amount for each share of stock they were investing in. Most market makers allow positions to be leveraged up to 100:1. This means that if a trader wanted to buy a “lot” worth $100,000, with 100:1 leverage the trader only has to put up $1,000.

Leverage is about risk. Increasing your leverage increases both your opportunity to take bigger profits AND rack up bigger losses.

Margin

Margin is a performance bond, or good faith deposit, to ensure against trading losses.

How are leverage and margin related?

The amount of leverage a market maker gives to a client defines the amount of margin that the client will have to commit in order to take a position in the market. For example, when leverage is 100:5, the “5” in the leverage ratio signifies the amount of capital the customer has invested of his own money, which is also known as the margin.

Bid and Ask

The bid rate is the price at which traders can sell the pair. The ask rate is the price at which traders can buy the pair.

This is the example of bid and ask on major currencies:

The ask rate will always be higher than the bid rate. The difference between the bid rate and the ask rate is the spread.

1 Comments:

MY SITE HAS MANEY USEFUL PRODUCTS FOR FOREX YUO CAN CHECK IT ,I'M SURE YOU WILL LIKE IT

THESE STUFF WILL HELP YOU IN FOREX TOO MUCH,SEE YOU IN MY SITE

http://www.commissionshops.com/shop/free-life-with-forex-trading

or this site

http://www.commissionshops.com/shop/trading-shop

Post a Comment

<< Home